We Invest in Sports, Do You?

We Invest in Sports, Do You?

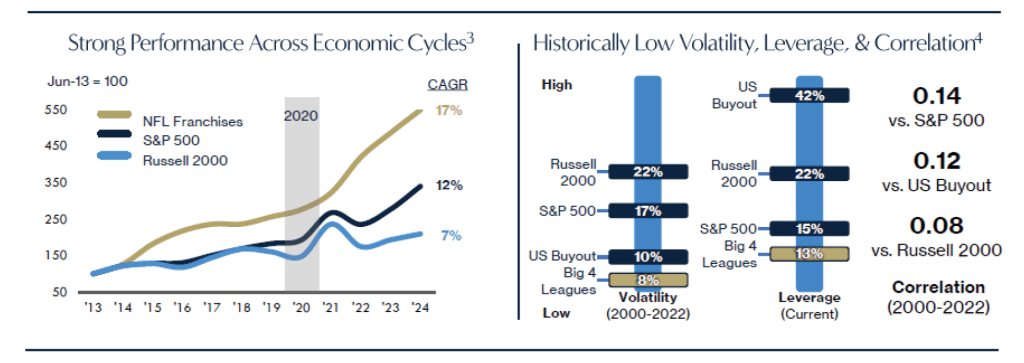

In a period of enduring change, one thing is clear: sports dominate the top 100-viewed programs. In fact, sports programming now accounts for 97 of the top 100 most viewed television programs. But how do you, the investor, benefit? It takes significant investment, experience, and lobbying to start a new team. Therefore, we at One Charles have spent half a decade pursuing passive ownership opportunities through our partners. Recently took our first active ownership position. In particular, the NFL has exhibited strong long-term performance with less volatility. Our partners at CAZ Investments have highlighted both the growth rate and the reduced volatility associate with professional sports. But, in a well-diversified portfolio, the lack of correlation becomes one of the most attractive elements.

The financial momentum behind sports investments has reached unprecedented levels, and franchise values have surged accordingly. This growth trajectory reflects a fundamental change in how sports generate revenue through media rights, global expansion, and technological innovation. Private equity’s recognition of this opportunity has been swift and decisive. PE firms hold stakes in eight of 32 NFL teams, following the league’s groundbreaking August 2024 decision to permit up to 10% institutional ownership. This institutional validation underscores what sophisticated investors have long recognized: sports franchises offer a unique combination of stable cash flows, appreciating asset values, and portfolio diversification benefits that traditional asset classes struggle to replicate.

While the barriers to entry remain high, the strategic partnerships and co-investment opportunities we’ve cultivated at One Charles provide our clients with meaningful exposure to this dynamic sector. As media consumption patterns continue to favor live sports content and global audiences expand, the investment thesis for sports ownership becomes increasingly compelling. For sophisticated investors seeking portfolio diversification beyond traditional alternatives, sports investments deserve serious consideration as a core component of a forward-looking allocation strategy.

Footnotes:

(3) Source: Arctos Partners, Forbes, Capital IQ (S&P 500 and Russell 2000 Prices represent Last Sale Price from June 30 of Selected calendar year to match Forbes reporting schedule); League return metrics are based on entry at the aggregate Forbes Equity value

(4) Source: Arctos Partners, Forbes 2022 valuation data, “Big 4” = NFL, NBA, MLB, and NHL; US Buyout: Burgess Private Capital Index, Arctos estimate based on 5x leverage/12x assumed purchase multiple; S&P & Russell 2000: Capital IQ as of December 2022. Standard deviation of returns from 2000-2022. Quarterly returns for US Buyout based on the Burgiss Private Capital Index. Source: Burgiss, Capital IQ, Forbes. Correlation of sports returns to selected category based on annual returns from 2000-2022 using June-to-June basis to match Forbes reporting schedule. Source: Forbes Burgiss Private Capital Index, Capital IQ

One Charles Private Wealth Services is an investment advisory firm registered with the Securities and Exchange Commission (“SEC”). SEC registration does not imply a certain level of skill and or expertise.

This summary is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be used or relied upon in connection with any offer or sale of securities. The information and statistical data contained herein have been obtained from sources that we believe to be reliable but in no way are warranted by us as to accuracy or completeness. Offers of a limited partnership interest in any vehicle mentioned will be offered only to qualified investors pursuant to a Private Placement Memorandum. This summary does not contain a description of the risks of an investment in the Partnership. A copy of the Private Placement Memorandum and related subscription documents is available to qualified investors from CAZ Investments, One Riverway, Suite 2000, Houston, TX 77056. Performance information is preliminary only and subject to confirmation by an audit. Unless otherwise noted, all performance is calculated based on net blended actual results for each Fund vehicle. The Fund offers a variety of fee levels to investors and the blended fee structure is based on the actual mix of fees charged for the period for which performance is reported. The rate of return achieved by a private fund will differ from the aggregate performance of underlying investment holdings due to various factors such as fund expenses, fees, and borrowings and other use of credit facilities by the private fund. Each investor’s returns will differ from the fund-level net blended performance due to differences in fee structures and, if applicable, borrowings and other use of credit facilities by the private fund. PAST PERFORMANCE IS NOT A GUARANTEE OF CURRENT OR FUTURE RESULTS. This summary is not an advertisement and is not intended for public use or distribution and is intended exclusively for the use of the person to whom it has been delivered by CAZ Investments. This presentation is not to be reproduced or redistributed to any other person without the prior consent of CAZ Investments. To the extent of any inconsistency between this summary and the Private Placement Memorandum, the terms of the Private Placement Memorandum control. The information contained in this summary reflects CAZ Investments’ current views at the time of publishing, but it should be expected that the information may no longer be accurate in the future. CAZ Investments reserves the right to change any information in this summary without notice but disclaims any obligation to update this summary to reflect subsequent developments. Historical examples included in this summary do not, nor are they intended to, constitute a promise of similar future results. Future market views by CAZ Investments may vary significantly from the historical examples presented herein and no one receiving this summary should assume that CAZ Investments will be able to replicate successful views in the future or that in any vehicle mentioned will be a profitable or suitable investment. Inquiries regarding performance or any other questions should be directed to CAZ Investments at 713-403-8250.

Disclaimer

The material provided is for informational purposes only. It is not meant to be considered advice or a recommendation to buy or sell any securities. One Charles Private Wealth Services, LLC is an investment adviser registered with the Securities & Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of One Charles Private Wealth Services by the Commission nor does it indicate that One Charles Private Wealth Services has attained a particular level of skill or ability.